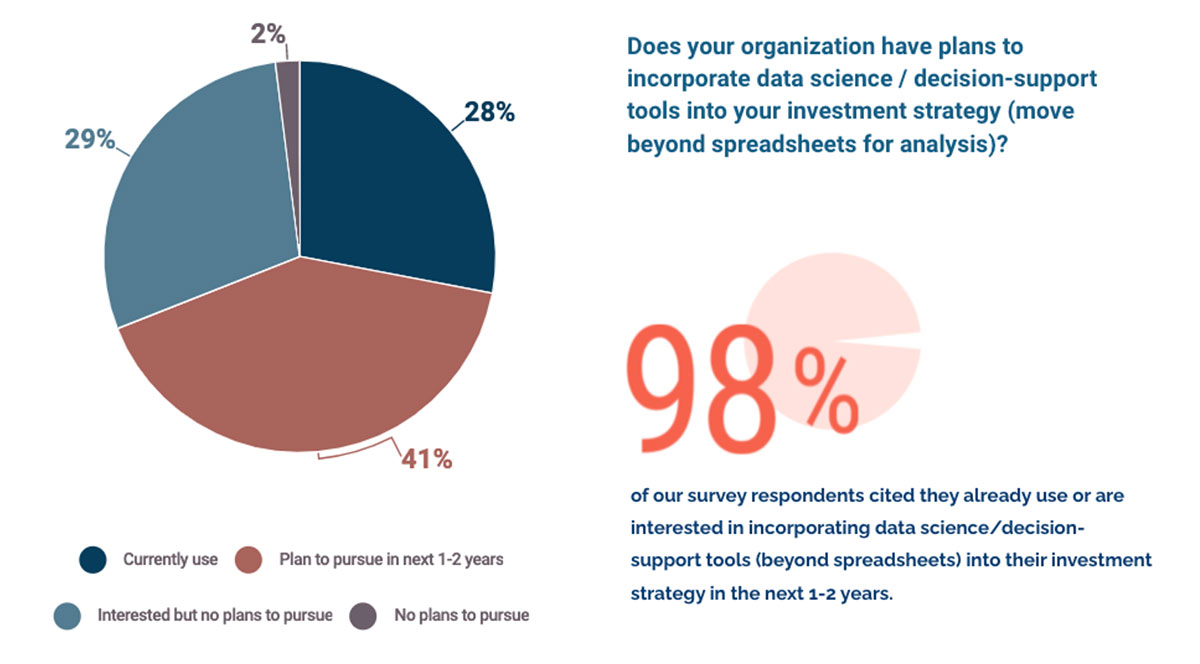

The proliferation and richness of data available to the financial services sector is already proving a profoundly disruptive force. For the asset management industry, harnessing its potential is a real and urgent challenge. Most firms are well aware that maximizing their data is the critical enabler in the hunt for alpha. Their challenge is this: how to make better use of that data to position it at the top of the decision-making value chain? In partnership with WBR Insights, Northern Trust surveyed 300 CEO’s, CIO’s, and Chief Data Information Officers from global asset management firms to find out what their strategies are for maximizing their data, how they incorporate that data into their investment process and their plans to leverage data science tools to optimize their investment performance.

Achieving alpha is not only an art, it is a science.

But, How to Implement Easily and Affordably?

The answer lies in technology. It’s no longer good enough for investment processes to live in spreadsheets or people’s heads. Measuring “success” extends beyond traditional returns and attribution. Institutional investors need their investment processes to be repeatable, digital, and measurable if they want to compete and succeed.

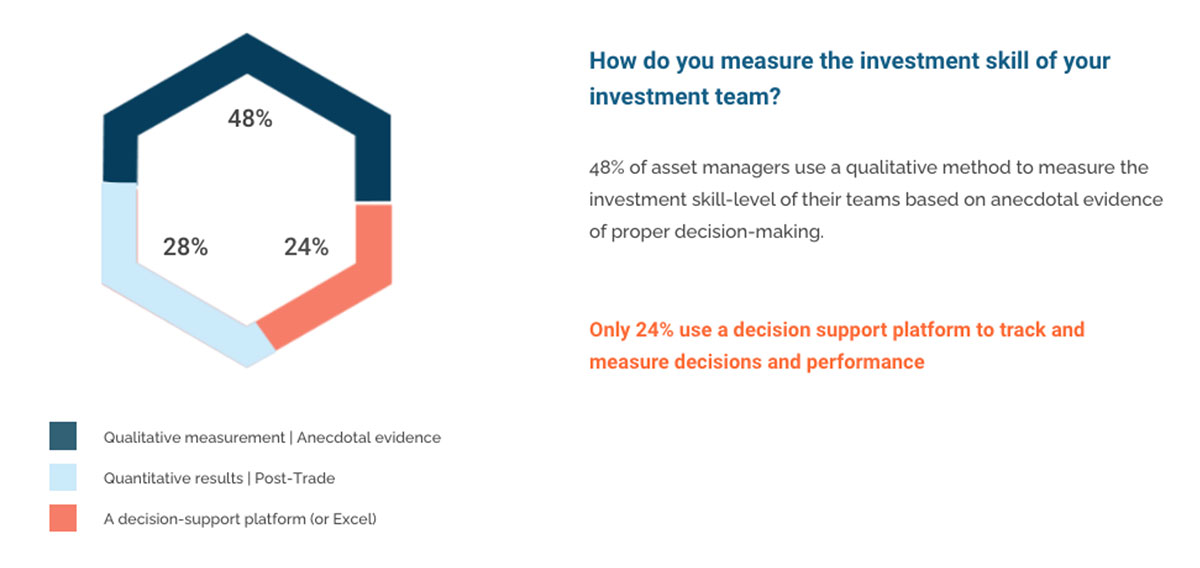

Managers can use technology to more effectively measure and improve performance, yet few do.

Being able to track performance over time creates a better learning environment. It creates more accountability, allowing managers to better understand which stocks they’re strong in and which stocks they’re weak in. And ultimately, it gives them the opportunity to make sure they surface the best ideas for their portfolios.

Please contact EDS at sales@equitydatascience.com for more information.