Active managers who are embracing technology to improve, adapt and measure their investment process are winning – both in performance and AUM.

Source: Excerpt from Casey Quirk’s – Righting the Ship – August 2020

Enhancing Investment Processes

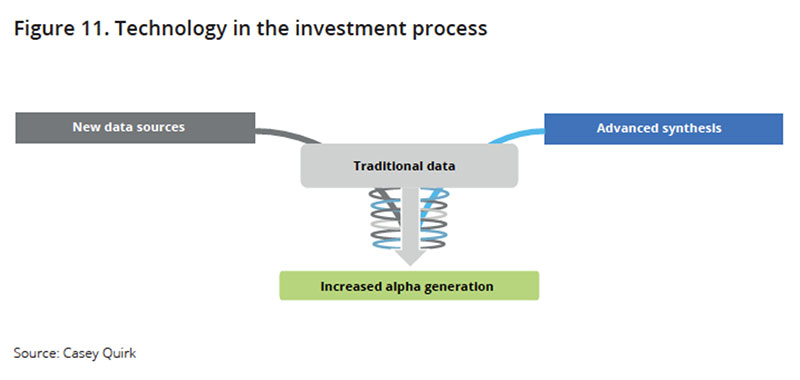

One of the biggest opportunities for managers of active listed equities resides within challenged strategies with high transformational potential aligned against strong demand. Technology has widened the toolkit for strengthening these weaker strategies, potentially improving consistent outperformance and differentiating such capabilities from less competitive peers. Successful asset managers likely will consider three approaches to enhancing challenged investment processes.

Use new information synthesis techniques and alternative data. Technology provides portfolio managers ways to find more signals faster, potentially improving their ability to deliver alpha. Artificial intelligence, machine learning, and natural language processing algorithms can quickly process vast seas of traditional equity research data, using computing power to create an information advantage from finding different correlations and conclusions. Better and faster data analysis also offers portfolio managers more informative diagnostics and scenario analyses that can pinpoint suboptimal trades, unhedged risk, and cognitive bias.

Newly created data sets will amplify the power of faster, better analytics. Advanced synthesis already can unlock information from unstructured data sets, such as search engine activity and social media. Revealing correlations between traditional and alternative data will give portfolio managers proprietary insights that they can apply to security selection. Integrated data analytics platforms will allow an asset manager’s investment professionals to share and leverage each other’s insights more effectively. Leading investment professionals operating in highly liquid, transparent markets such as quoted equities increasingly will need to be, or employ, expert coders that harness the power of an organization’s data and analytic infrastructure. Simply securing technology and data is necessary, but insufficient. Successful transformation will require integrating these capabilities into existing investment teams. This will require asset management firms to become comfortable with new types of talent, such as data scientists.

Please contact EDS at sales@equitydatascience.com for more information.