EDS is a Decision-Support & Analytics platform for fundamental investors. Originally developed inside of multiple successful funds, it is now available commercially, helping leading funds become more systematic & data-driven for investment workflows, such as Idea Generation, Portfolio Construction & Risk Management As part of the 2020 CFA Research Challenge, EDS is providing a glimpse into their award winning platform for students. The EDS Idea Generation Module:

- The benefits of combining multiple, time-series charts to tell a story.

- How to find the “DRIVERS” of my stocks. In statistical terms – which metrics are correlated to the stock price.

- More efficient research, such as valuation, price target and peers analysis.

Case Study on Merck (MRK)

Over the past 10 years, Merck has underperformed the S&P 500 (approx. 9% vs. 11% annualized). However, over the last three years, it has kept pace with the S&P 500. Has the company turned the corner? Can it start to outperform? While it is beyond the scope of our expertise to provide an opinion, one of the strengths of EDS, is the ability to understand “change”, helping focus investors on the metrics that matter.

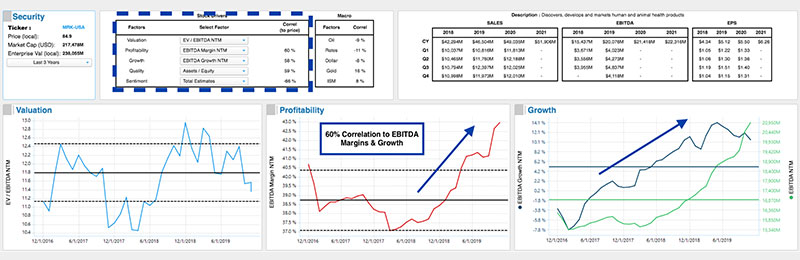

MERCK FUNDAMENTAL TIME-SERIES ANALYSIS (EDS TEARSHEET)

Figure 1. Stock Drivers / Correlation: Rigorous research increasingly includes statistical analysis, which is difficult in Bloomberg, and is inefficient in excel. The EDS Tearsheet provides on-the-fly correlation/regression and time-series analysis across an unlimited set of metrics. For Merck, over the past three years, EBITDA Margins are 60% correlated with the stock price. This might suggest that investors are heavily focused on margins.

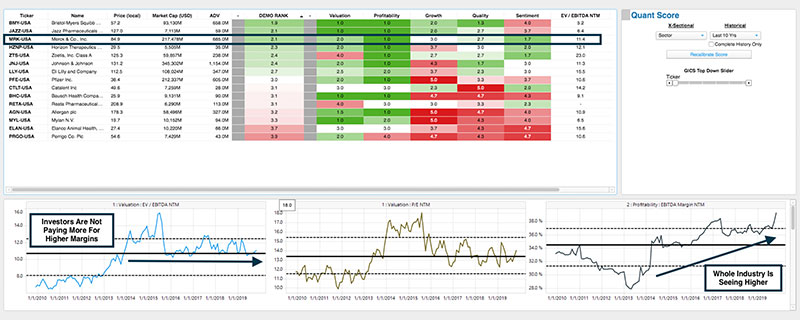

PHARMA INDUSTRY TIME-SERIES ANALYSIS (EDS SCREENING)

Figure 2. Cross-Sectional Industry Analysis: While it is important to focus on Merck, we also need to put their performance into context. relative to the US Pharma industry. EDS provides rigorous search, screening and ranking, both historically and cross sectionally (snap shot in today’s market). In this case, margins have been rising for the whole group, not just Merck. In addition, the valuation multiple (EV/EBITDA) investors are paying has been flat for several years. A natural question for your research would be to ask why are investors paying a flat valuation multiple for better margins?.

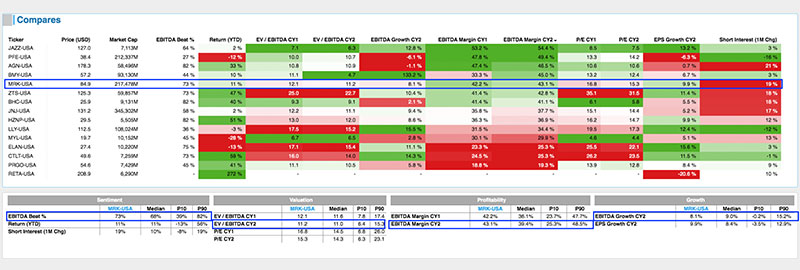

MERCK PEER ANALYSIS (EDS COMP SHEET)

Figure 3.: While Merck’s margins are slightly higher than peers, its forecasted growth rate is a bit lower. Making the case for a higher valuation (the EV/EBITDA 2020 multiple of 11.2X is inline with peers and its 2020 PE of 15.3X is already higher) would likely rest on the company exceeding estimates. A case for this might be made, as we can see Merck has beaten EBITDA estimates 73% of the time over the last three years. However, offsetting this outperformance is a 19% increase in short interest over the past month.

Good luck to the students of the 2020 CFA Research Challenge.

For more information about Equity Data Science, please see our website at www.equitydatascience.com.

Please contact EDS at sales@equitydatascience.com for more information.